This is the last article you can read this month

You can read more article this month

You can read more articles this month

Sorry your limit is up for this month

Reset on:

Please help support the Morning Star by subscribing here

IT IS clear that the financial class is intensely worried about the consequences of a no-deal Brexit.

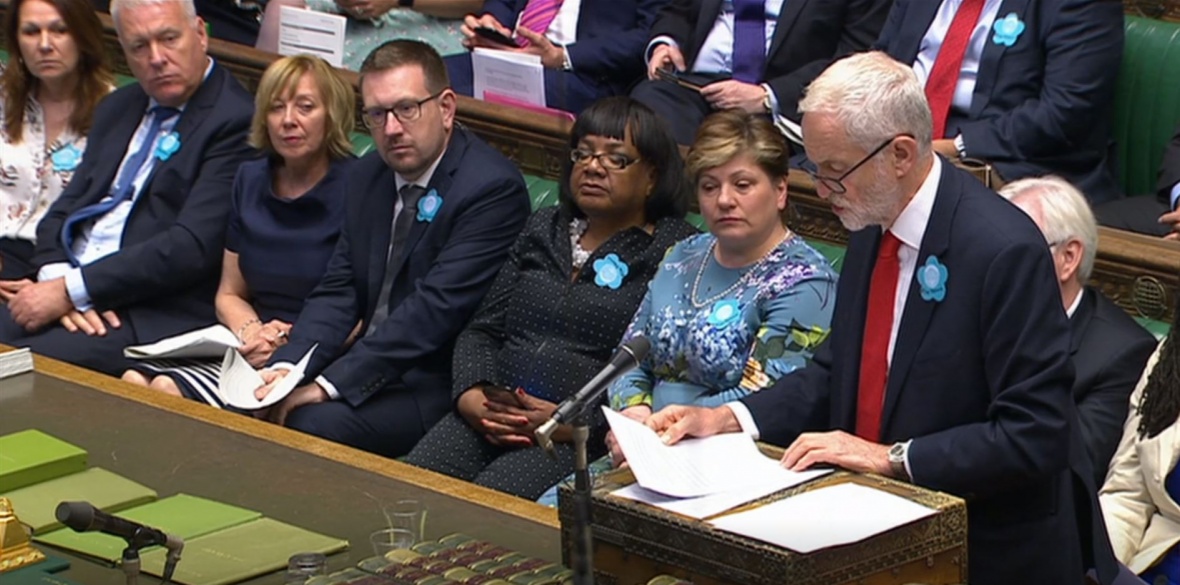

Yet the signs are that it may well be more worried about the prospects of a general election in which Jeremy Corbyn’s Labour has a fighting chance.

After weeks of nervous Johnson-related headlines, the FT led with a Labour-baiting story proclaiming that the party’s proposals to transfer share ownership to workers “would cost UK companies £300 billion.”

It is difficult to make Corbyn look aggressive and steely-eyed, but hats off to the FT’s photoshop team for achieving just this with the image that accompanied this story.

Reading between the lines, the story was concocted from a report commissioned by Britain’s — perhaps the world’s — largest corporate law firm, Clifford Chance.

The report claimed that Labour’s proposed transfer of £300 billion worth of shares to workers (the equivalent of 10 per cent of stock) in 7,000 of the largest companies, combined with — horror of horrors — a “right to buy scheme” for private rental tenants, would be “one of the biggest raids on the private sector in a Western democracy.”

Not only that, said Clifford Chance partner Dan Neidle, it would provoke “litigation from aggrieved companies and shareholders.”

Neidle was merely echoing last month’s warning in the FT of corporate litigation against Labour’s plans to nationalise utilities.

No prizes for guessing exactly who would be first in line to represent those litigious companies in the British courts and the international tribunals.

Of course, £300bn worth of shares is not an insignificant amount. But if we were to set the cost of this proposal against just one year of surplus made by corporate shareholders in the UK, it begins to look like a very modest proposal.

Indeed, a cost of £300bn is far less than the combined value of profits and share dividends in the top 100 companies projected for this year.

While the rest of the country continues to reel from the fallout of the bank bailout and the austerity measures that the majority are paying very dearly for — some with their lives — it is boom time for shareholders in British companies.

Share dividends in 2018 hit record highs. Last year, the average UK dividend yield (the payout calculated as a proportion of share price) hit 4.8 per cent, the highest since 1989.

This year, it is set to remain well above average. A number of big firms are in such a good position they have been paying out extra “special dividends” this year.

RBS dished out £903 million and Rio Tinto, the mining group, $1bn in special dividends.

The cost of Labour’s proposal adds up to less than a third of the £1 trillion allocated by the Treasury in the post-2008 bank bailout.

Although the Treasury ended up shelling out less, the bailout involved a much larger shift in wealth from the public to the private sector than that proposed by Labour in the opposite direction.

But it is not just the totals that count. If Labour was to begin to shift the balance of corporate power in this way, this would represent a progressive shift that would benefit the entire economy, rather than simply reinvesting in the financial elite.

The post-crash bailout involved a series of overpriced share purchases, direct payments and quantitative easing which virtually shovelled public resources straight into the pockets of financial shareholders, doing nothing to address the precarious nature of financial investment that brought the system to its knees in the first place.

Moving the money in the other direction, such as Positive Money’s idea of “quantitative easing for the people,” or Labour’s plans to dilute the financial power of corporate elites, is likely to provide social dividends for a much broader base of the population and make us more financially stable.

In truth the value of the transfer of shares to workers suggested by the Labour Party will not do much to shake the foundations of the City, or of shareholders across Britain.

It is, however, a step in the right direction, and a signal that there is an alternative to allowing a minority of elite shareholders and anonymous, unaccountable financial institutions to run the economy and the planet into the ground.

David Whyte is a professor of socio-legal studies, and is working on a new research project for the Institute of Employment Rights: “Employment Rights and the Shareholder” (with Ben Crawford, University of Liverpool and Aristea Koukiadaki, University of Manchester).