THE latest figures for the British economy are being positively spun by the Tories and many pro-big business analysts – and negatively by those who want to blame Brexit wherever possible.

Unemployment has fallen slightly, although it remains at 3.8 per cent of the labour force. These days, that is trumpeted as a low proportion. Yet between the 1944 White Paper on Employment Policy and the late 1960s, any rate above 2.5 per cent would have been regarded as a national scandal.

Since the Thatcher years in the 1980s, more than 3 per cent has become the norm as governments and companies prioritise the drive for lower inflation and higher profits.

A small spurt in income growth is also being hailed as evidence of how workers are reaping the benefits of economic recovery. Yet most of the growth is at the higher end of the income scale, while workers at the lower end will see much of their pay rise swallowed up by escalating housing, energy and transport costs.

Today’s new statistics indicate a slowdown in Britain’s economy in April, caused primarily by annual shutdowns in motor manufacturing brought forward from August. Predictably, this has been seized upon by pro-EU fanatics at the Guardian and elsewhere as proof that Brexit is destroying key sectors of the British economy.

Yet this fall in manufacturing activity followed a spike in production in anticipation of the March 29 Brexit Day that never happened. Unfortunately, car production will soon take a far more significant downturn as a result of mass redundancies in Swindon and Bridgend, adding to the crisis in Britain’s steel industry.

Despite mendacious efforts, again, to hold Brexit responsible, all three companies concerned — Honda, Ford and British Steel — have made clear that this has little or nothing to do with what is an international contraction in their industries.

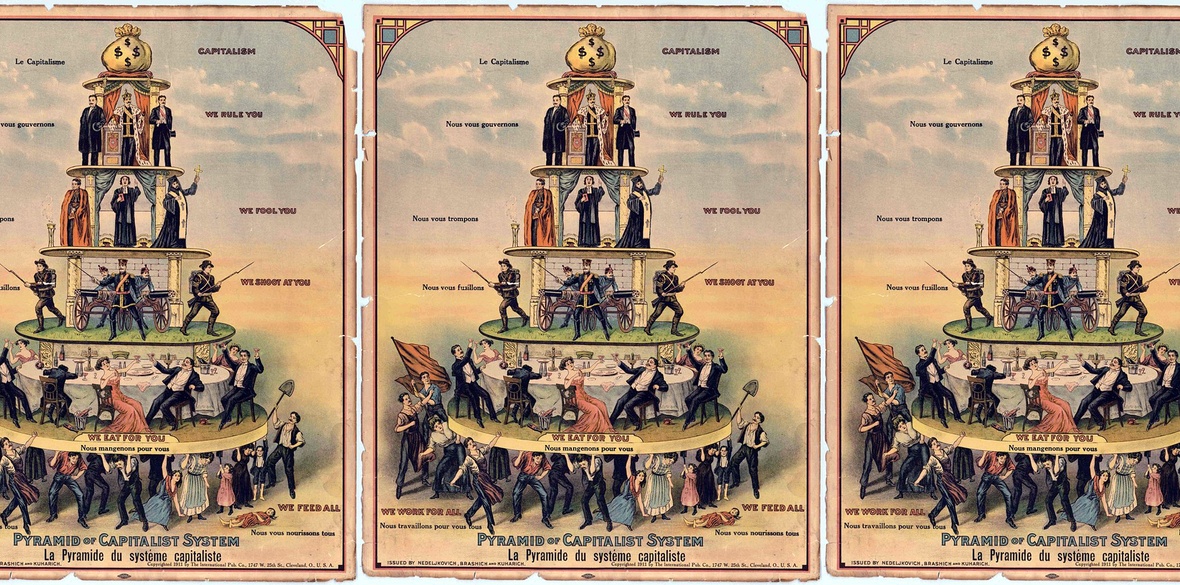

One regrettable consequence of the overwhelming focus on Britain, Brexit and Europe is that so little attention is being paid to the deteriorating prospects for the international capitalist economy.

Last month’s Economic Outlook from the OECD estimated that year-on-year global economic growth — long buoyed up by China — will continue this year to fall from its peak in 2017. Likewise, investment is dropping and trade growth is heading for next-to-nil. The same report highlighted the negative role being played by national debt, trade conflicts and poverty.

The IMF World Economic Outlook published in April is even more revealing. It added problems in the eurozone and natural disasters to the factors responsible for the global slowdown.

Significantly, it devoted a whole chapter to the baleful impact of expanding monopoly power on the prospects for growth and prosperity, especially in the advanced capitalist countries.

According to the report, the giant corporations are using their market power to mark up their prices and profits, having little incentive to boost their output and invest in machinery, technology and innovation. Holding back economic growth and the demand for labour also holds down pressure for higher wages.

This year’s IMF Global Financial Stability Report repeats previous warnings that corporate debt, volatile capital flows, trade imbalances, Eurozone conflicts and unstable housing markets are increasing the medium-term risks to capitalism’s international financial system.

As champions of “free market” capitalism, the IMF and OECD have to put on a brave face about the future. But by their own analyses, Brexit or no Brexit, we are heading into choppier economic — and social and political — waters.